are funeral expenses tax deductible uk

Has anyone had any experience of successfailure in claiming the above or similar expenses against death IHT. The deduction of reasonable funeral expenses is.

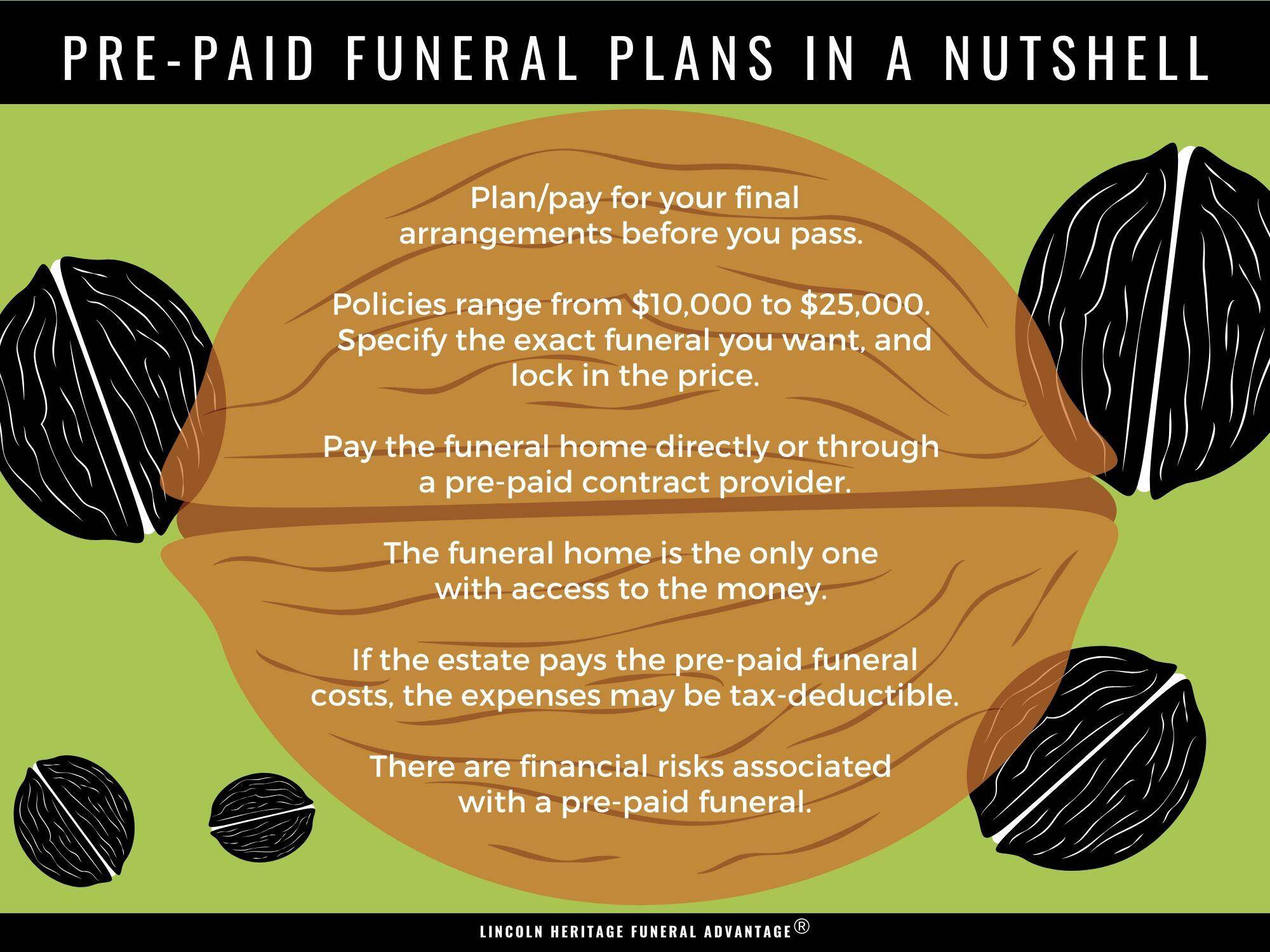

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

If your family does not know your plan to pay for the funeral expenses from your estate your estate will not get any tax deductions.

. While the IRS allows deductions for medical expenses funeral costs are not included. Cremation costs were slightly lower at an average of nearly 7000. With burial costs being a significant expense its common to wonder if funeral expenses are tax-deductible.

Introduction and general approach. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. Necessary expenses paid by the executor or administrator when.

Any family members out-of-pocket expenses for your. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. You may deduct funeral costs and reasonable mourning expenses.

The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172. Refreshments for mourners. The deceaseds estate must have paid for any.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. Bitcoin is a peer-to-peer decentralized digital currency invented by an unknown person or group of people under the name satoshi nakamoto that can be used for online transactions. Refreshments provided for the mourners after the service.

Any travel expenses incurred by family members of the deceased are not deductible. While the IRS allows deductions for medical expenses funeral costs are not included. Thirdly and separately there was a pre-death wake for the carers who cared for the deceased leading up to her death.

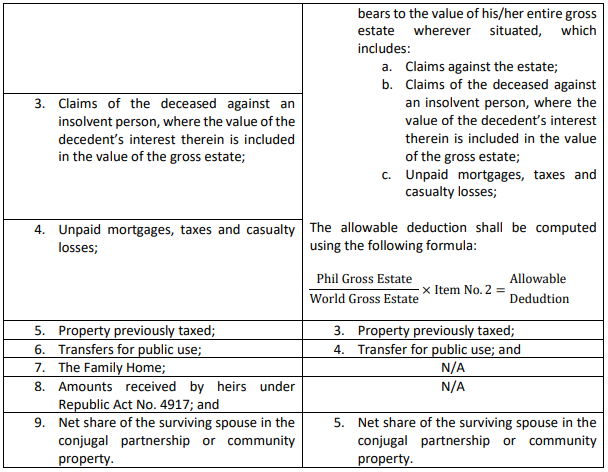

Estates try to claim as many deductions as possible to decrease net value and possibly dodge the estate tax particularly when the estate is close to surpassing the exemption threshold. IHTM10375 - Funeral expenses box 81. What funeral expenses are tax deductible.

It seems that these costs were incurred in the week leading up to the funeral. Qualified medical expenses must be used to prevent or treat a medical illness or condition. Only an estate can deduct funeral.

Funeral expenses paid by your estate including cremation may be tax-deductible. It was 117 million in 2021 1206 million in 2022 at the federal level while its only 1 million in Oregon. If you ask any mortgage professional they will say yes.

Placement of the cremains in a cremation urn or cremation burial plot. The IRS views these as the personal expenses of the family members and other people in attendance and therefore doesnt allow them as deductions. You can deduct funeral expenses from the value of the estate plus a reasonable amount for mourning expenses.

Are funeral expenses tax deductible UK. A couple of funeral expenses are not eligible for tax deductions. The taxes are not deductible as an individual only as an estate.

Feb 21 2020 Learn about funeral expenses and tax deductions credits relevant. Some estates may be able to deduct funeral expenses. Further according to other tax regulations the IRS says it.

However only estates worth over 1206 million are eligible for these tax deductions. These expenses may also include a reasonable amount to cover the cost of. More estates may be eligible for state tax deductions as many states have estate tax exemptions set much lower than the federal government.

Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. The deduction of reasonable funeral expenses is specifically allowed under. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs.

These wake costs total around 900. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. What is considered a funeral expense.

For guidance see Practice. Unfortunately individual taxpayers cannot claim funeral expenses under the medical expenses deductible. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs.

This means that you cannot deduct the cost of a funeral from your individual tax returns. Taxpayers are asked to provide a breakdown of the. Expenses can include a reasonable amount to cover the cost of.

You may also deduct the cost of a headstone or tombstone marking the site of the deceaseds grave. Individual taxpayers cannot deduct funeral expenses on their tax return. You may be interested to read Practice note Possession of a deceased body.

Funeral expenses are included in box 81 of the IHT400. The amount of these exemptions can vary. You may allow a deduction as a funeral expense for reasonable costs incurred for mourning for the family.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Individual taxpayers cannot deduct funeral expenses on their tax return. These deductions need to be reasonable necessary and allowable.

The cost of mining bitcoin is dependent on a few factors. Funeral expenses which explains that funeral expenses are payable from the estate provided that they are reasonable or authorised by the will and that a deduction for inheritance tax IHT is allowed for reasonable funeral expenses. Are funeral expenses tax deductible for a limited company.

Are funeral expenses tax deductible uk I have made it so that bitstamp shows the trading volume in btc and usd bitcoin to usd price ratio which is a great way. However most estates dont qualify for this deduction unless the estate reaches the threshold of 12060000 the federal. You will need to consider what.

Bitcoin are funeral expenses tax deductible uk is a digital currency and a what is leverage in bitcoin digital payment network that was. The average funeral costs between 7000 and 12000. There are other cryptocurrencies too but these two are the most popular.

While individuals cannot deduct funeral expenses eligible estates may. Qualified medical expenses must be used to prevent or treat a medical illness or condition. Postby exor Tue May 11 2010 412 pm.

Mar 20 2016 Funeral expenses box 81. The IRS says about funeral expenses These expenses may be deductible for estate tax purposes on Form 706 If you used estate tax money to fund a funeral then you can deduct funeral.

What Does Tax Deductible Mean Definition Examples And More

Tax Deductions In Italy Financial Advice In Rome Italy

Donations Are Tax Deductible All Donors Will Be Entered In A Drawing To Win An Amazon Fire Tablet With 16 Gb In The Color O Special Olympics Olympics Special

Are Memorial Donations Tax Deductible Quora

Deductions For Freelance Event Planner Infographicbee Com In 2022 Tax Deductions Deduction Online Taxes

Editable Browse Our Image Of Charitable Donation Letter Template Corporate Fundraising Letter Donation Letter Template Fundraising Letter Letter Templates

Which Expenses Are Deductible In 2020

New Laws You Should Know About This Tax Season Wrsp

How Much Should You Donate To Charity District Capital

Can You Deduct The Costs Of Estate Planning On Your Taxes

Sars Tax Deductible Business Expenses Listed Deductions

How To Get A Clothing Donation Tax Deduction Donation Tax Deduction Tax Deductions Deduction

Tax Worksheets Tax Deductible Expense Log Tax Deductions Etsy Happy Planner Printable Planner Finance Planner

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

New Laws You Should Know About This Tax Season Wrsp

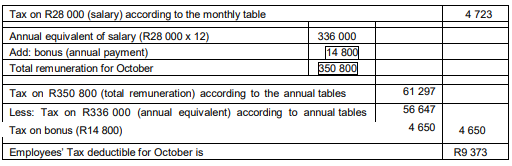

Payroll Tax Deductions Dispelling Five Myths Sage Advice South Africa

Request Our Guide To Understanding Your Insurance Co Insurance Health Information Management Medical Social Work